https://www.streetwisereports.com/article/2021/06/03/precious-metals-investing-stay-focused-and-stay-long.html

The first investment newsletter that I ever read was sent to me by

one of our brokerage clients back in 1979 and it was called "Dow Theory

Letters," written by the man that inspired me to do what I do today, the

legendary and late Richard Russell.

Notwithstanding a few unbelievable market calls, such as the top of

the Great Bull Market in 1966 and the end of the 1973–1974 bear market

within days, it was his storytelling that captivated me. As a bombardier

during WWII, he related the terror of riding through anti-aircraft

barrages with wax in each ear while trying to identify targets in the

bomber's viewmaster, and while I longed for his sage market guidance, it

was the stories that kept me a dutiful subscriber until his passing in

2015.

Russell had a great many friends and colleagues in the investment

industry and often praised them for particularly important market calls,

or even passing observations or opinions, but one thing that I never

observed was a Richard Russell ridicule or even mild criticism of his

competitors. He carried honor into battle as a badge and it was one of

the reasons why the last big testimonial dinner for him a few years

before his passing was a "standing room only" affair. There has not been

an investment newsletter that even slightly compares with "Dow Theory

Letters," and the wisdom it bestowed upon the unsophisticated investor,

and the humility with which it was delivered.

Another newsletter personality that remains a friend to this day is

Robert (Bob) Bishop, formerly the publisher of the Gold Mining Stock

Report from 1983 to 2007. While I always admired Bob's writing prowess,

he had an uncanny knack of zeroing in on the really big

exploration stories. In fact, his voluminous encyclopedic report in 1991

entitled "Diamonds in North America" was the finest piece of

educational data that I have ever read and that still stands today.

There was nary a writer on the planet who had a clue about what was

going on in the summer of 1991, and what investors have to understand is

that Bob's report triggered a CA$200 million staking rush way up in the

frozen tundra, followed by massive financings for the junior

diamond explorers. While the success of Dia Met Minerals in its move

from the pennies to over $80/share helped bring in new subscribers, Bob

deserved to receive royalties from the promoters, fund managers and

investment bankers who pocketed millions of dollars in fees and capital

gains.

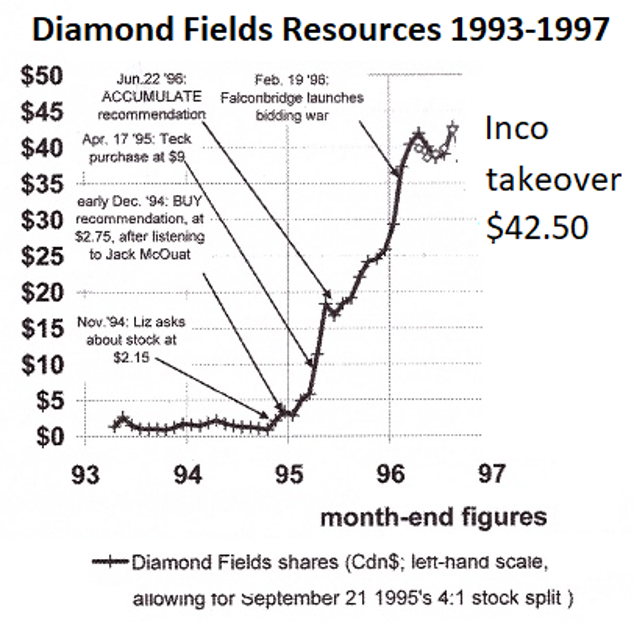

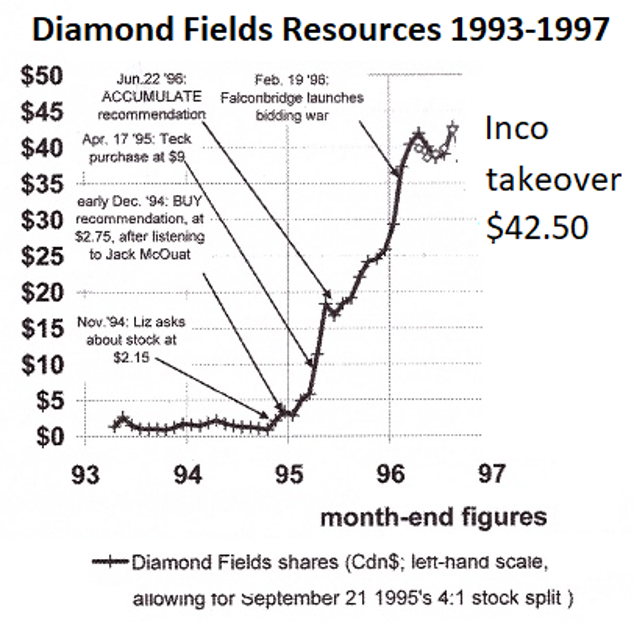

Now, if you thought that his foray into Diamonds-101 as a crash

course was a one-off, once-in-a-lifetime blessing bestowed by the two

goddesses of junior mining (Mother Nature and Lady Luck), it was only a

few years later, in 1993, that Bob repeated the performance by being the

first writer to talk about a possible nickel discovery in northeast

Labrador, by way of a Robert Friedland company called "Diamondfields

Resources," which actually turned out to be an even bigger win than Dia

Met (pennies to $170/share pre-split).

I recall having lunch with Bob in Toronto around 2007, in the early

days after he retired from the business, and I was raving on and on

about the statistical improbability of having nailed not one but two major, world-class discoveries in one career,

let alone the half-decade time frame. The ever-humble Bishop

interjected, correcting me by saying "You forgot about Arequipa"—sold to

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) for CA$1.1 billion in 1996—another Gold Mining Stock Report recommendation that made his subscribers fortunes.

As the years have rolled by and mimeographed newsletters arriving my

regular mail were replaced with whirring fax machines in the wee hours

of the morning, the arrival of the internet age allowed greater access

to investment information in terms of both reduced costs and increased

availability. Today, in 2021, it is the macrocosm of internet access and

proactive social media marketing that has altered the landscape for the

newsletter community. With Zoom-type technology, everyone with a nice

smile and the gift of gab is now racing to get us to press the "Like"

button so they can get paid by the advertisers.

The newsletter writers of the 1990s and 2000s have shuttered their

laptop keyboards for make-up trays and teleprompters, so it is not

unusual to see the same topic discussed twenty-five times in various

interviews over a two-day period. It is like a game of musical chairs as

everyone rushes to interview "my friend <Insert Newsletter Guy

here>," at which the amount of fawning and bowing and promoting of

the "guest expert's acumen" and investment advisory service becomes somewhat counterintuitive.

Well, we all better get used to it because the world is moving like a

laser beam on steroids these days, and between cryptocurrency

volatility, stock market overvaluation and the Great Inflation Debate,

any narrative driving millennials and GenXers to buy stocks can change

literally overnight. We saw Bitcoin go from hero to zero with one Elon

Musk tweet, proving without argument that the old days of extensive "due

diligence" (a thoroughly abused phrase these days), like Bishop's

"Diamonds in North America," would take up far too much valuable time

for the Millennials and GenXers to show any serious interest. Rather, a

text message or a tweet from "someone they know" about a "good stock to

buy" sends millions of shares of volume racing through the virtual

universe, only to arrive on the asking side of the quote, swamping

anything and everything in its path, resulting in short-selling hedge

fund managers being carried out on stretchers.

I have a few friends in the newsletter community, and as I cannot

seem to get the corporate finance bug out of my system, I invite them to

join me from time to time in one of my endeavors. The forgotten concept

of reciprocity works well with us older guys, because it was Brien

Lundin's tip on Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTCQX)

in late 2018 that prompted me to add it to my portfolio in 2019 at

CA$2.20/share (Brien's subscribers owned it from under CA$0.50). The

move it made after the Dixie discovery in the Red Lake camp, to over

$15/share, was breathtaking, and the way this "geriatric protocol" works

is that I give full credit to the idea generator with a two-word

punctuation mark called a "thank you." Imagine that.

The price of gold last week made an assault on the formidable

US$1,910–1,920 resistance, but was summarily rejected, leaving gold

barely above the magical US$1,900 level on the week. Silver also had an

assault of the $28.50 resistance zone, and too was soundly repelled. I

exited my long gold futures position on a $1,901 stop-loss after

reloading back at the March lows around $1,678/share. All in all it was

another great trade but, sadly, leaves me once again flat, and nervous.

Well, I am not really "flat," because my largest personal holding, Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), is trading within $0.08 of a 52-week and all-time high, and is ahead 85.29% year-to-date.

I have been obscenely vociferous in my constant (and I am sure very

annoying) trumpeting of the merits of Getchell, but after all I

discussed earlier regarding newsletter writers, the one attribute that I

have hopefully learned from the Russells and Bishops of the world is

that when you have done all of your homework and results are coming in

and are exceptional, you must stay focused; follow the strength of your convictions; and stay long.

I see gold, silver and copper all trading sideways for a bit longer

before all moving to new highs, so line up your favorite developer in

the crosshairs and pick your price. The upcoming move is going to be

life-altering, and you must be "egregiously long" before the Chatanooga

choo-choo leaves the station.

Originally published Friday, May 28, 2021.

Follow Michael Ballanger on Twitter @MiningJunkie. He is the Editor and Publisher of The GGM Advisory Service and can be contacted at miningjunkie216@outlook.com for subscription information.

Originally trained during the inflationary 1970s, Michael Ballanger

is a graduate of Saint Louis University where he earned a Bachelor of

Science in finance and a Bachelor of Art in marketing before completing

post-graduate work at the Wharton School of Finance. With more than 30

years of experience as a junior mining and exploration specialist, as

well as a solid background in corporate finance, Ballanger's adherence

to the concept of "Hard Assets" allows him to focus the practice on

selecting opportunities in the global resource sector with emphasis on

the precious metals exploration and development sector. Ballanger takes

great pleasure in visiting mineral properties around the globe in the

never-ending hunt for early-stage opportunities.