Let’s use this simple yet effective stock scan to highlight eight trade-trending (or fading) candidates right now:

This scan was created from FinViz.com’s Screener Tool focusing on the stocks most over and under extended from the 200 day SMA.

The scan charts the stocks farthest away from the average in percentage terms.

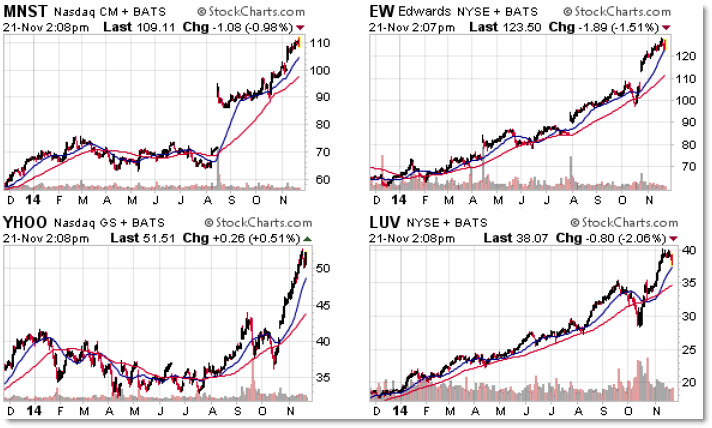

Right now, Monster (MNST) is the most extended and trending stock, followed by Edwards Life Sciences (EW), Yahoo (YHOO), and Southwest Airlines (LUV).

The general strategy here is to highlight these as strong relative strength candidates and put these on watch-lists for future buy signals, usually on retracements.

The more aggressive strategy is to play a “Mean Reversion” strategy which calls for fading overextended stocks as they (ideally) move back toward rising averages (a counter-trend, short-term play).

Personally, I prefer pro-trend strategies but you can use this list however best fits your trading goals.

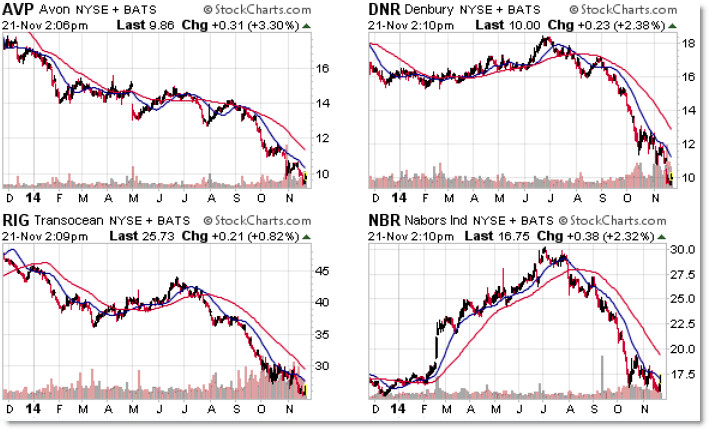

Our downtrending extending stocks include the following:

Avon Products (AVP), Denbury (DNR), Transocean (RIG), and Nabors Industrials (NBR).

Please share this article