FREE download click here

The Gods of the Copybook Headings by Rudyard Kipling

As it will be in the future, it was at the birth of Man

There are only four things certain since Social Progress began.

That the Dog returns to his Vomit and the Sow returns to her Mire,

And the burnt Fool’s bandaged finger goes wabbling back to the Fire;

(To read the entire poem, go to: http://www.kipling.org.uk/poems_copybook.htm )

John Embry and Andrew Mickey

Andrew Mickey: Thanks for joining us today John. A lot has happened since we last talked in February. Basically, it looks like almost everything we looked at last time - gold, silver, agriculture, and other hard assets – continue to be out of favor. There have been “gold shoots,” but nothing really sustainable.

That’s why, today, I want to get into a few more specific topics with you. And one thing that's really hot right now is what's going on in

The S&P 500’s five-month moving average climbed to 974.39 yesterday, higher than the 15-month moving average of 972.56, according to data compiled by Bloomberg.

The five-month moving average rose above the 15-month line three other times in the past two decades: March 1991, October 1994 and July 2003. Each cross foreshadowed returns of at least 16 percent during the following 18 months. (more)

Historians will look to September 2008 as a watershed for the U.S. economy.

On Sept. 7, the government seized mortgage titans Fannie Mae and Freddie Mac. Eight days later, investment bank Lehman Brothers filed for bankruptcy, sparking a global financial panic that threatened to topple blue-chip financial institutions around the world. In the several months that followed, governments from Washington to Beijing responded with unprecedented intervention into financial markets and across their economies, seeking to stop the wreckage and stem the damage. (more)

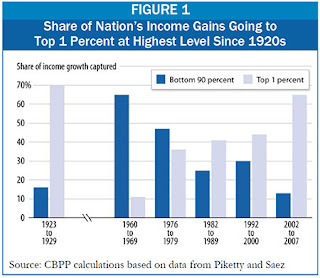

Two-thirds of the nation’s total income gains from 2002 to 2007 flowed to the top 1 percent of U.S. households, and that top 1 percent held a larger share of income in 2007 than at any time since 1928, according to an analysis of newly released IRS data by economists Thomas Piketty and Emmanuel Saez.[1]

Two-thirds of the nation’s total income gains from 2002 to 2007 flowed to the top 1 percent of U.S. households, and that top 1 percent held a larger share of income in 2007 than at any time since 1928, according to an analysis of newly released IRS data by economists Thomas Piketty and Emmanuel Saez.[1] During those years, the Piketty-Saez data also show, the inflation-adjusted income of the top 1 percent of households grew more than ten times faster than the income of the bottom 90 percent of households.

The last economic expansion began in November 2001 and ended in December 2007, according to the National Bureau of Economic Research, which means the Piketty-Saez data essentially cover that expansion. The last time such a large share of the income gain during an expansion went to the top 1 percent of households — and such a small share went to the bottom 90 percent of households — was in the 1920s (see Figure 1). [2] (more)

A Treasury report showed 360,165 people had their monthly payments reduced through August, up from 235,247 through July, but a senior Treasury official conceded much more must be done to soften the impact of a severe and prolonged housing crisis.

"The recent crisis in the housing sector has devastated families and communities across the country and is at the center of our financial crisis and economic downturn," Michael Barr, assistant Treasury secretary for financial institutions, told a House Financial Services subcommittee. (more)

Earlier this year, quite by happenstance, I read a book written by Pulitzer Prize-winning reporter James B. Stewart.

Earlier this year, quite by happenstance, I read a book written by Pulitzer Prize-winning reporter James B. Stewart.Britain was within hours of a banking shutdown last autumn as the government battled to piece together a rescue plan for the stricken Halifax and Royal Bank of Scotland, it has emerged.

Treasury mandarins and Bank of England officials battled the clock to come up with a support package on the weekend of 12 October. If they had failed, the Financial Services Authority could have ordered the closure of cash machines and prevented deposits at either of the two main casualties of the global financial chaos. (more)