The Gold Report

Thibaut

Lepouttre, editor of Caesars Report, knows ’tis the season for

generosity, so when we asked him for his top three picks among junior

mining equities, he gave us five—four gold plays and a phosphate name.

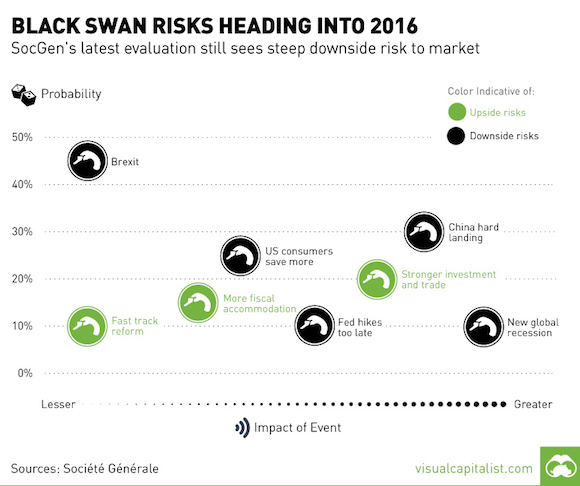

Belgium-based Lepouttre also discusses different “black swan” events and

their potential impact on the gold price, as well as some naughty and

nice mining jurisdictions. But this is the interview that keeps on

giving, so before he left Lepouttre added two micro-cap oil names he

believes would make great “stocking stuffers.” He may not be Santa Claus

but you’ll appreciate his magnanimity in this interview with The Gold

Report.

The Gold Report: The Chinese yuan will soon join the

International Monetary Fund (IMF) Special Drawing Rights (SDR) currency

basket. The Chinese government hopes the yuan’s inclusion will help

undermine the U.S. dollar as the world’s reserve currency. What will the

likely impact be on gold?Thibaut Lepouttre: Yes, the IMF has agreed to add the yuan to the SDR basket. At 11% the Chinese yuan will have a higher weighting in the SDR basket than either the Japanese yen or the British pound. But what’s surprising is the rather small cut in the U.S. dollar ratio in the basket. The weighting will go down to 41.73% from 41.9%, just 0.17%. The Chinese will have to wait a few more years to see a significant cut in the weighting of the U.S. dollar.

Continue Reading at TheAuReport.com…