Investors looking for the best cheap stocks to buy sometimes find themselves taking big risks. Namely, the stocks they purchase often are microcap penny stocks that have zero revenue and very thin trading volume.

five 2015’s Best Cheap Stocks to Buy Now: 7 Picks Under $10That’s a recipe for disaster.

Consider that earlier this year, the FBI just conducted a massive sting operation to capture penny stock fraudsters — and agents were shocked by the brazen way some folks are trying to manipulate these investments. That’s because cheap stocks that trade at a thin volume on the “pink sheets” are a playground for criminals looking to move the share price of an investment by any means necessary to make a quick buck.

If you’re insistent on finding to cheap stocks to buy now, then, be careful about looking at just share price alone. (more)

Please share this article

Thursday, November 13, 2014

There's a Big Energy Opportunity Setting Up Right Now

Energy traders are about to have the chance to make big, quick profits...

As regular readers know, the price of oil has tumbled over the past

few months. The benchmark West Texas Intermediate (WTI) crude oil price

is down 25% since it peaked in June.

And it has taken shares of oil companies with it. For example,

Bakken shale-oil powerhouse Continental Resources is down more than 25%.

Eagle Ford producer Sanchez Energy has fallen more than 50%.

But investors haven't just fled oil companies. Nearly every company

in the energy sector is down since June... including natural gas

producers. (more)

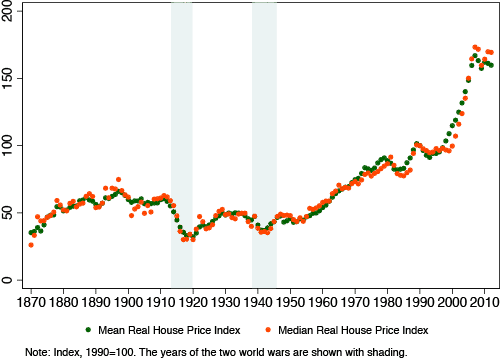

Home prices since 1870: No price like home

House price fluctuations take centre stage in recent macroeconomic

debates, but little is known about their long-run evolution. This column

presents new house price indices for 14 advanced economies since 1870.

Real house prices display a pronounced hockey-stick pattern over the

past 140 years. They stayed constant from the 19th to the mid-20th

century, but rose strongly in the second half of the 20th century.

Sharply increasing land prices, not construction costs, were the key

driver of this trend.

Read more ›

Please share this article

Read more ›

Palladium Is Still The Best of the Metals

One of the more interesting developments in recent weeks is the

increased selling pressure in precious metals. Gold and Silver are two

metals that we’ve wanted to be aggressively short for some time now.

This has worked out well as prices continue to hit multi-year lows. But

one thing that stands out from the group is the continued outperformance

from Palladium. When we review our commodities charts, this one

definitely stands out from the rest.

Here is a 3 year chart of Palladium compared to Gold, Silver and Platinum. The outperformance here clear:

It’s no wonder that with Silver down almost 20% this year, and gold and platinum also down, that somehow Palladium is up 8% for 2014. The pair trades continue to work.

Here is a chart of the Palladium/Silver pair hitting 10-year highs this week. I don’t see any evidence yet that this trend has changed:

Please share this article

Here is a 3 year chart of Palladium compared to Gold, Silver and Platinum. The outperformance here clear:

It’s no wonder that with Silver down almost 20% this year, and gold and platinum also down, that somehow Palladium is up 8% for 2014. The pair trades continue to work.

Here is a chart of the Palladium/Silver pair hitting 10-year highs this week. I don’t see any evidence yet that this trend has changed:

Please share this article

Penny Stock Pick, Viggle, Inc. (NASDAQ: VGGL)

We have a NASDAQ company that is primed for a bounce with a recent

analyst upgrade to buy and a tiny float. This one could move fast and

triple digit gains are definitely a possibility in the very near term.

Viggle, Inc. (NASDAQ: VGGL)

Highlights

Current $1.61/share

Viggle was trading in the $5.50/share range just this September.

Chart is looking way over sold (see below)

Full analyst report and price target issued 11-11-14 here: http://smallcapir.com/wp-content/uploads/2014/11/VGGL-CR-IR-1.pdf

Please share this article

Highlights

Current $1.61/share

Viggle was trading in the $5.50/share range just this September.

Chart is looking way over sold (see below)

Full analyst report and price target issued 11-11-14 here: http://smallcapir.com/wp-content/uploads/2014/11/VGGL-CR-IR-1.pdf

Please share this article

Subscribe to:

Comments (Atom)