Saturday, February 27, 2021

Friday, February 26, 2021

ZBH21 T-Bond Mar '21

If the price of Treasury Bonds is heading down then interest rates are heading up. What do you think that will do to the price off all your investments?

Thursday, February 25, 2021

KEK21 Hard Red Wheat May '21

KEK21 recently became a buy with the moving averages cross over and just made new highs. A $1,200 profit per contract in only 4 trading days

GME Gamestop Corp

GME is back in play with a doubling in price today. Moving averages , RSI and volume are all bullish, how high can it go this time?

Wednesday, February 24, 2021

ZSK21 Soybean May '21

Soybeans broke out of their one month consolidation to the upside. The RSI is above 50, all moving averages are sloping upward and price is still above 50 dma. Still bullish.

Tuesday, February 23, 2021

LIT G-X Lithium ETF

LIT is now sitting on support of the 50 day moving average and $65 price support, the short term moving averages are crossing and the RSI already broke below 50. Not good signs.

TSLA Tesla Inc

It's starting to look ugly in the EV sector. TSLA broke support at $780 the other day, the moving averages are crossing downwards and the RSI broke below 50. Other stocks like LI, XPEV, and NIO have similar patterns. Is this the end or just a temporary pullback?

Monday, February 22, 2021

SAVA Cassava Sciences Inc

SAVA had a huge spike almost 20X then corrected more than 60% and we may be getting ready for the next up move.

Friday, February 19, 2021

RSRUSD RSR

RSRUSD broke out in stages, the chart shows resistance became support twice. If the pattern continues again it would be a good entry point near 0.05 support.

RUNEUSD RUNE

RUNE brokeout of it's consolidation back in late December from $1 to $5 in less than 2 months. It has now been in a coil pattern waiting for another breakout. Which way?

ADAUSD Cardano / US Dollar

Cardano (ADA) price has jumped 9 fold from the 10 cent BUY given to us in early October using only the RSI as a signal. However the last weeks worth of trading may be giving us "warning signs".

ETHUSD Ethereum - USD

Ethereum gave us a BUY signal on October 9, 2020 at $363 using only the RSI and has kept us long since. 5X return in just 4 months.The RSI is still strong but the volume is slowly decline, so still bullish.

Thursday, February 18, 2021

Wednesday, February 17, 2021

CBAT Cbak Energy Technology Inc

CBAT has been consolidating for 3 months now , it's getting ready to break out of the coil. Which way?

ZWK21 Wheat March 2021

Wheat went from 570 to 690 then corrected and found a bottom at 630 (near previous resistance), the moving averages cross is about to give a buy and we may see new highs.

ZOH21 Oats March 2021

Oats has corrected slightly and using the moving averages crossover as the signal we now have a buy, possibly to new highs.

Tuesday, February 16, 2021

APHA Aphria Inc

QS Quantumscape Corp

QS has pulled back about 75% of it's advance and looking at the RSI and moving averages, it may be ready to move back up.

Gold Platinum Spread

Saturday, February 13, 2021

Total warns of 10mn b/d oil supply shortfall by 2025

Underinvestment, Opec+ production restraints and cracks in the US shale model risk a 10mn b/d global oil supply shortfall between now and 2025, Total said today.

The speed and extent of oil demand recovery from falls arising from the Covid-19 pandemic depend largely on vaccines and the implementation of economic recovery packages around the world, Total's president of strategy and innovation Helle Kristoffersen said.

"What is clear, on the other hand, is that there is a risk of a supply crunch in the mid-term," Kristoffersen said. "Given the natural declines in existing oilfields… the message is simple: we need new oil projects and that is true even if you take a very cautious view on short-term demand recovery and on future demand levels."

Total will continue to invest in oil and gas, which it says is key to funding its transformation into a broader energy company — to be rebranded TotalEnergies — that will have sharper focus on low-carbon products.

Total expects its hydrocarbons production to remain stable from 2020 at around 2.84mn b/d of oil equivalent (boe/d) this year, as a recovery in Libyan production and a relaxation of quotas in Opec+ countries offset declines elsewhere, and then sees its production rising to 3.3mn-3.4mn boe/d by 2025, with the majority of this growth from 2023.

It expects first oil from the Lake Albert oil development in Uganda and from the Mero 3 project offshore Brazil from 2024, and is targeting first oil from Block 58 offshore Suriname in 2025. It has few projects coming on stream in the next two years, chief executive Patrick Pouyanne said today.

Total has an exploration budget of $800mn in 2021, which is "lower than before" and focuses on "low-cost development projects," Pouyanne said.

https://www.argusmedia.com/en/news/2185346-total-warns-of-10mn-bd-oil-supply-shortfall-by-2025

How much silver is used in a Tesla?

The following article appeared here originally https://katchum.wordpress.com/2020/09/23/how-much-silver-is-used-in-a-tesla/

Keith Neumeyer reported that a tesla uses at least 1 kg of silver.

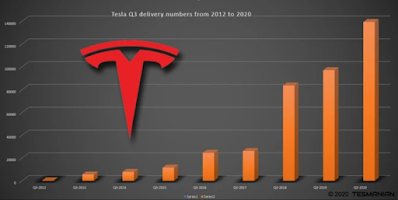

The latest Tesla delivery numbers in Q3 2020 were a record 139300. That’s almost 600000 per year.

If Tesla builds 1 million vehicles per year, that would translate into 1 million kg or 1000 tonnes of silver demand per year. Yearly silver demand is 20000 tonnes today. So Tesla would gobble up 5% of silver demand. The EV industry is growing rapidly, so this number could go up exponential. Tesla says it will 50 fold its production to 20 million vehicles per year by 2030.

Friday, February 12, 2021

E6H21 Euro FX Mar '21

Euro has support at 1.1950 and has broken the down trend line from the recent highs, moving averages and RSI are positive.

Thursday, February 11, 2021

DBC DB Commodity Index Fund Invesco

DBC very long term chart of the commodity index fund, looks like it may have formed a bottom and ready to move much higher. A long term buy.

ZCH21 Corn March 2021

Corn futures have faded from 7+ year highs after the U.S. Department of Agriculture (USDA) projected supplies of the grain would be well above market expectations. The bull may be over. Similar chart patterns with wheat and the soybean complex.

Wednesday, February 10, 2021

AI C3.Ai Inc Cl A

AI a relatively new stock, is forming an ascending triangle, it went through it's first level of resistance, up next is the old highs of $184 then clear sailing upwards.

XL XL Fleet Corp

CLWD Cloudcommerce Inc

CLWD jumped from half a cent to 18 cents, then pulled back 62% (full Fibonacci retracement) and formed a double bottom. Now looks like it's making it's next move higher.

Tuesday, February 9, 2021

Monday, February 8, 2021

Saturday, February 6, 2021

Friday, February 5, 2021

VRM Vroom Inc

VRM appears to have formed a double bottom (ok almost), and is now touching the $44 area which has been support and resistance over the past 6 months. The stock has 10 strong buy ratings with price targets between $45 and $76.

Thursday, February 4, 2021

SABR Sabre Corp

SABR is in an industry that has been decimated by the pandemic from the drop in travel, but if/when it comes back we may see some nice returns with this stock. It's getting ready to breakout and make some fresh highs.

NNA Navios Maritime Acquisition Corp

NNA this low cap has a PE ratio of 3 and has earnings coming out on Feb 4, 2021. If they are good the stock might be able to break the down trend.

ETHE Grayscale Ethereum Trust

ETHE Ethereum made an all time high today, although Grayscale did not even though it trades at a nice premium. If you believe in ethereum but would prefer to invest in stocks this is how you do it.

Wednesday, February 3, 2021

Tuesday, February 2, 2021

RSRUSD RSR

RSRUSD is now on support around 30, now waiting for a break of the downtrend line. RSI still above 50.

OCEANUSD Ocean Coin

OCEAN formed a W pattern and may soon be ready for a pop. Waiting for the break just above 60 or the break below the upward trendline.

SNPW Sun Pacific Holding Corp

SNPW jumped from less than a penny to 35 cents, then corrected 82% of the advance,and now looks like it may be ready for the next leg up.

CVLB Conversion Labs

CVLB stock was up 14% today primarily on a tweet from Citron Research who have a "value" of $140 / share.

URA G-X Uranium ETF

URA started correct from it's advance, and just popped again along with the jump in silver. If it can hold the low then it may start a new bull move.

Monday, February 1, 2021

SILJ Purefunds ISE Junior Silver ETF

SILJ also perking up is the Junior Silver ETF holding silver stocks. It will take very little for it to break out and move higher.

AGQ Ultra Silver Proshares

AGQ the silver pro shares are 2X and it's where you want to be if silver is going to explode due to a short squeeze. Will it materialize? Time will tell.