Insuring oneself from disaster is financially prudent, whether you're a corporation or individual. To that end, the global insurance market has grown to be a $4.3 trillion dollar industry. Analysts expect that growth to continue, reaching over $5 trillion by 2014. However, one question does remain; who insures the insurers? Providing that backstop is a specialized group of reinsurance firms. When catastrophes strike, it's up to these companies to protect the losses of the better-known primary insurers like Allstate (NYSE:ALL). With the recent earthquake/tsunami disasters in Asia, robust damage from hurricane Irene in the Northeast and the tornado damage affecting the Midwest, the reinsurance sector has seen their stock prices plummet. In spite of the losses, the reinsurers could be one of the better "deep values" in today's market. Investors may want to take notice.

Insuring oneself from disaster is financially prudent, whether you're a corporation or individual. To that end, the global insurance market has grown to be a $4.3 trillion dollar industry. Analysts expect that growth to continue, reaching over $5 trillion by 2014. However, one question does remain; who insures the insurers? Providing that backstop is a specialized group of reinsurance firms. When catastrophes strike, it's up to these companies to protect the losses of the better-known primary insurers like Allstate (NYSE:ALL). With the recent earthquake/tsunami disasters in Asia, robust damage from hurricane Irene in the Northeast and the tornado damage affecting the Midwest, the reinsurance sector has seen their stock prices plummet. In spite of the losses, the reinsurers could be one of the better "deep values" in today's market. Investors may want to take notice.Looking Past the Storm Clouds

Despite the recent losses for the reinsurers, many analysts now think the sector could be a 'buy' going into the final quarter of the year. Currently, firms in the sector are trading at 85 to 90% of their book value. This is well below the historical long-term average of 120 to 130%. The industry is also seeing rising rates for catastrophe insurance. After 15 months of events such as 2010's Chilean earthquake and 2011's Japanese tsunami disaster, the industry has finally been able to significantly raise rates. Already in Asia, rates for large property reinsurance policies have risen nearly 60% since March. Analysts estimate that 2012 renewal rates for both Europe and North America will see large increases as well.

The sector is also benefiting from strong capital positions and conservative investments. Reinsurers within the Aon Benfield Aggregate (ABA) index, report total capital reserves of $242.4 billion as of June. Despite the robust climate for disasters over the last year or so, total reserve capital only fell by 1.7% since 2010. Analysts at Standard and Poor's said it would take a natural disaster that erodes 5 to 10% of reserve capital of the whole sector, before it would change its stable rating. Similarly, rating agency Fitch estimates that it would take a further $75 billion in insured losses over the next 24 months to cause concern in the sector.

Finally, the sector could be seeing increased sales in the next few months. Europe's massive financial regulatory overhaul (called Basel II) will require more companies to purchase additional reinsurance policies. This ultimately will enhance returns that reinsurers generate when they invest premiums, despite the low investment yield environment.

Reinsuring a Portfolio

With the reinsurance sector trading at historically low levels, now could be good time for investors to add to the sector. Funds like the SPDR KBW Insurance (NYSE:KIE) or the PowerShares Dynamic Insurance (NYSE:PIC) allow investors to bet on wide swath of the insurance industry. However, there are plenty of individual picks for those wanting more reinsurance focus.

Hurricane Irene left an estimated $7 billion to $13 billion of damage in its wake, far less than the initial predictions. To that end, the trio of Everest Re Group (NYSERE), RenaissanceRe (NYSE:RNR) and PartnerRe (NYSE:PRE) have the greatest sensitivity to hurricane season and could be good buys on the news.

Despite its recent losses due to the Midwest tornados, Montpelier Re (NYSE:MRH) could make an interesting buy. The company is undergoing a transformation by shedding its mono-line property catastrophe reinsurer yoke and moving towards a more diversified global reinsurer. Montpelier also remains focused on returning value to shareholders through share buybacks and dividends. Shares of the company yield 2.5%.

Finally, for those who want more safety from their reinsurance investments, there's everyone's favorite value investor, Warren Buffett. Via Berkshire Hathaway (NYSE:BRK.B), Buffett is one of the world's biggest reinsurers. Similarly, White Mountains (NYSE:WTM) boasts a variety of reinsurance lines among its operating subsidiaries.

The Bottom Line

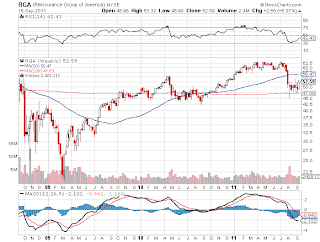

In the wake of an unprecedented year of natural disasters, the reinsurance sector has seen many of their share prices plummet. However, due to this decline many stocks within the sector - like Reinsurance Group of America (NYSE:RGA) - are now trading at historic lows relative to book value. For investors, the time may be right to pounce on the values.

No comments:

Post a Comment