After an up-and-down October that saw Ebola fears, worries about the state of the European Union and slowing Asian growth all hit the market, the stock market has rallied, and the S&P 500 and Dow Jones Industrial Average have notched record highs on several occasions.

With the current dividend yield of the S&P 500 sitting at a meager 1.86% and 10-year Treasuries sitting at just 2.25%, the stock market looks like a tempting place to invest your money. And what better place for a risk-shy income investor with a hankering for a bit of capital appreciation than the stodgy, blue-chip-heavy Dow Jones Industrial Average?

While not every stock in the Dow is a screaming yielder, you can find a lot of income on the higher end. For instance, even the worst of the top 10 dividend stocks in the Dow yields 2.8% — and once you get to the top, you’re looking at yields north of 5%! (more)

Please share this article

investmentresearchdynamics.com / Dave Kranzler /

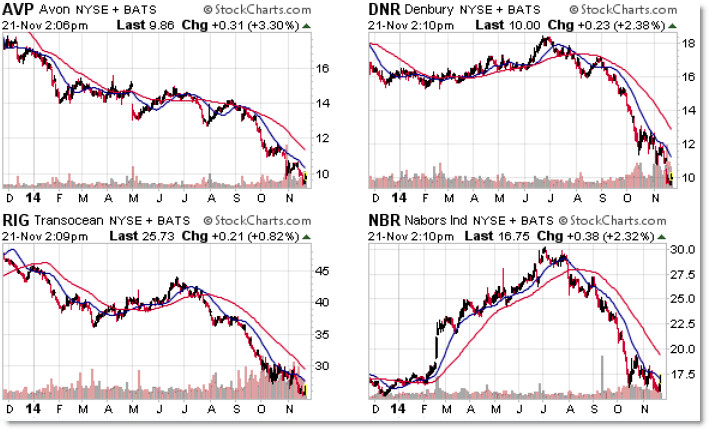

If it is, I don’t know of anyone who saw that coming. I have been asserting over the past month or so that the plunge in the price of oil is the best indicator that the global economy - including and especially the U.S. economy – is collapsing.

There had been a bubble of sorts blown up in the shale oil industry. Billions in junk bonds have been issued against what is turning out to be the latest of Wall Street’s financial engineering Ponzi schemes. But what everyone seems to be overlooking is that the banks and private equity firms themselves are going choke on the billions in bank debt issued by the collapsing shale oil industry.

READ MORE

.PNG)

.png)