Monday, October 31, 2022

Wednesday, October 26, 2022

How to Find Stocks that will 10X | Simple Steps

In this presentation, Roy Mattox, Hedge Fund Manager and professional investor, shares 20 easy steps to finding the next great growth stock like tesla apple or amazon.

Tuesday, October 25, 2022

Monday, October 24, 2022

Sunday, October 23, 2022

Friday, October 21, 2022

PAUL TUDOR JONES - Billion Dollar Stock Trader (200 day moving average)

PAUL TUDOR JONES - Is a billion dollar stock trader and was ranked as the 108th richest man in the world on the Forbes 400 rank.

Book - https://amzn.to/3qugX79

Jones is the founder of Tudor Investment Corporation which is also ranked as number 13 as the richest hedge fund in the world. Needless to say when Jones gives advice, everyone listens...

Jones's stock trading philosophy is quite simple; Achieve a favourable risk reward ratio, which should be a minimum of 5 to 1. Stay with the trend, determined by the 200 day moving average, and buy at turning points which are often referred to as pull backs within a predominant trend.

Also known as a contrarian investor, a trend following advocate, and an excellent risk manager, Jones was famous for predicting the 1987 crash, Black Monday.

Wednesday, October 19, 2022

Charles Nenner: Stock Market CRASH, October 21, 2022

A Special Interview with Charles Nenner. The 2022 Stock Market is mimicking the 1929 Stock Market which may indicate that October 21, 2022, may be a very dangerous time frame for many asset classes. If it is a repeat of 1929, then the trading days around October 21, 2022 could be very, very volatile. Charles further forecasts the Fed Rate which appears to indicate NO RELIEF for interest rates. Plus, or minus a couple of days from October 21, 2022. Time to take actions.

Rick Rule Is Buying These Silver Stocks + Uranium Hot Take

Special Coverage from the New Orleans Investment Conference - Guest Rick Rule discusses the silver stocks he is currently buying, discusses the latest Uranium news, and drops some knowledge for gold & silver investors

Saturday, October 15, 2022

Friday, October 14, 2022

Using The Commitment Of Traders (COT) Reports

You may have heard about the Commitment of Traders (COT) Reports, and how they are used to understand the market dynamics. But what, exactly, do they tell you? And why should you use them if you trade futures or options on futures? In this special session, Barchart welcomes John Rowland, who brings years of futures trading experience to the discussion.

John talks about the importance of using the COT reports, and demonstrated how to read and interpret the data you find on each. He then showed how you can use the Commitment of Traders reports in your trading.

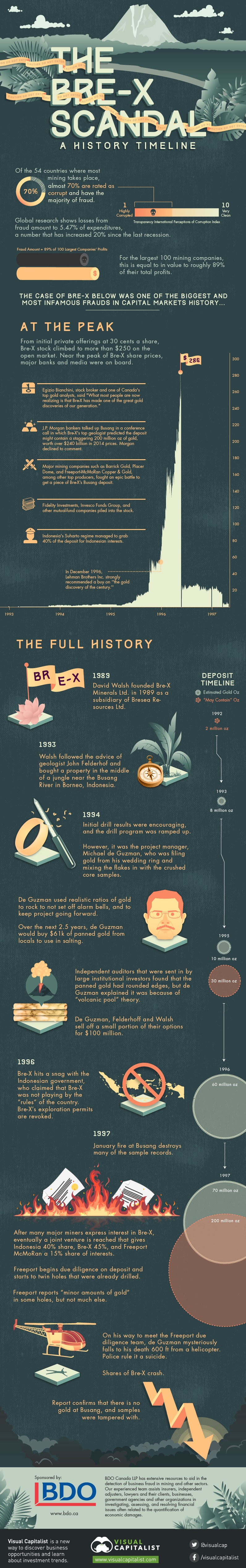

Bre-X Scandal: A History Timeline

Bre-X Scandal: A History Timeline

Sponsored by: BDO and BDO Natural Resources LinkedIn Group

This infographic documents the rise and fall of Bre-X.

From initial private offerings at 30 cents a share, Bre-X stock climbed to more than $250 on the open market. Near the peak of Bre-X share prices, major banks and media were on board:

The Peak

- It was touted by media and banks as the “richest gold deposit ever”

- In December 1996, Lehman Brothers Inc. strongly recommended a buy on “the gold discovery of the century.”

- Major mining companies such as Barrick Gold, Placer Dome, and Freeport-McMoRan Copper & Gold, among other top producers, fought an epic battle to get a piece of Bre-X’s Busang deposit.

- Indonesia’s Suharto regime managed to grab 40% of the deposit for Indonesian interests.

- Fidelity Investments, Invesco Funds Group, and other mutual-fund companies piled into the stock.

- J.P. Morgan bankers talked up Busang in a conference call in which Bre-X’s top geologist predicted the deposit might contain a staggering 200 million oz of gold, worth over $240 billion in 2014 prices. Morgan declined to comment.

- Egizio Bianchini, stock broker and one of Canada’s top gold analysts, said “What most people are now realizing is that Bre-X has made one of the great gold discoveries of our generation.”

The Timeline:

1989: David Walsh founded Bre-X Minerals Ltd. in 1989 as a subsidiary of Bresea Resources Ltd.

1993: Walsh followed the advice of geologist John Felderhof and bought a property in the middle of a jungle near the Busang River in Borneo, Indonesia.

1994: Initial drill results were encouraging, and the drill program was ramped up.

1994: However, it was the project manager, Michael de Guzman, who was filing gold from his wedding ring and mixing the flakes in with the crushed core samples.

De Guzman used realistic ratios of gold to rock to not set off alarm bells, and to keep project going forward.

Over the next 2.5 years, de Guzman would buy $61k of panned gold from locals to use in salting.

Independent auditors that were sent in by large institutional investors found that the panned gold had rounded edges, but de Guzman explained it was because of “volcanic pool” theory.

De Guzman, Felderhoff and Walsh sell off a small portion of their options for $100 million

1996: Bre-X hits a snag with the Indonesian government, who claimed that Bre-X was not playing by the “rules” of the country. Bre-X’s exploration permits are revoked.

1997: January fire at Busang destroys many of the sample records.

1997: After many major miners express interest in Bre-X, eventually a joint venture is reached that gives Indonesia 40% share, Bre-X 45%, and Freeport McMoRan a 15% share of interests.

1997: Freeport begins due diligence on deposit and starts to twin holes that were already drilled.

1997: Freeport reports “minor amounts of gold” in some holes, but not much else.

1997: On his way to meet the Freeport due diligence team, de Guzman mysteriously falls to his death 600 ft from a helicopter. Police rule it a suicide.

1997: Shares of Bre-X crash.

1997: Report confirms that there is no gold at Busang, and samples were tampered with.

Tuesday, October 11, 2022

CTZ22 Cotton #2 Dec '22 Is Cotton getting reading for lift off?

Cotton has broken through the down trend line and has also formed a bullish divergence with the RSI, the low 80's look to be strong support.

Monday, October 10, 2022

Saturday, October 8, 2022

Friday, October 7, 2022

Tuesday, October 4, 2022

Monday, October 3, 2022

CDNS Cadence Design Sys may have bottomed

CDNS corrected the full Fibonacci retracement of 61% and bounced, the stock is now above the 10sma, and RSI broke above 50. So far so good.